41 treasury bonds coupon rate

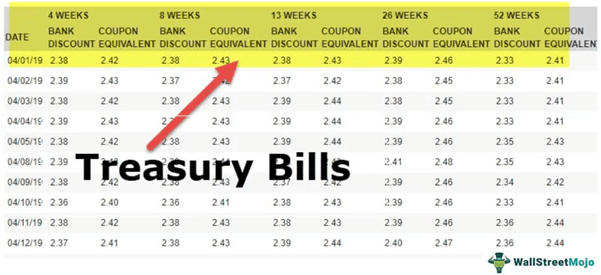

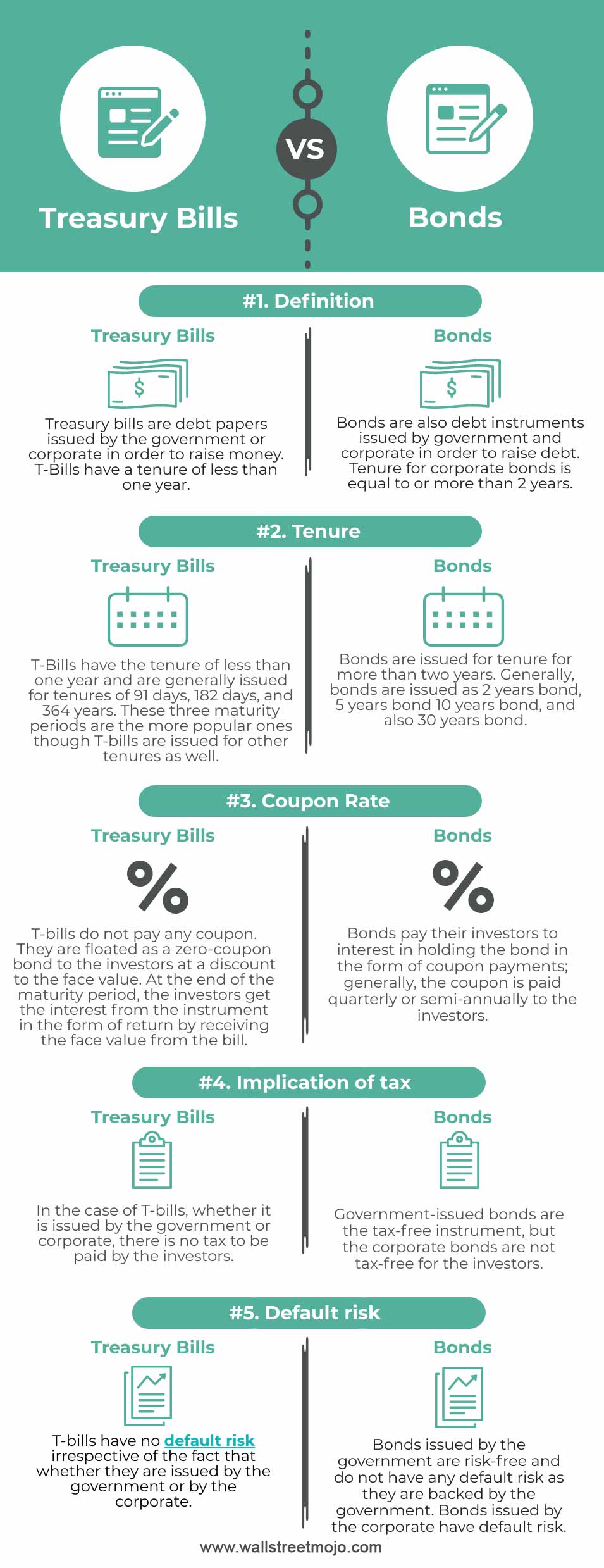

home.treasury.gov › policy-issues › financialSanctions Programs and Country Information | U.S. Department ... Oct 28, 2022 · OFAC administers a number of different sanctions programs. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. Where is OFAC's country list? Active Sanctions Programs: Program Last Updated: Afghanistan-Related Sanctions 02/25/2022 Balkans-Related Sanctions 10/03/2022 Belarus ... › terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

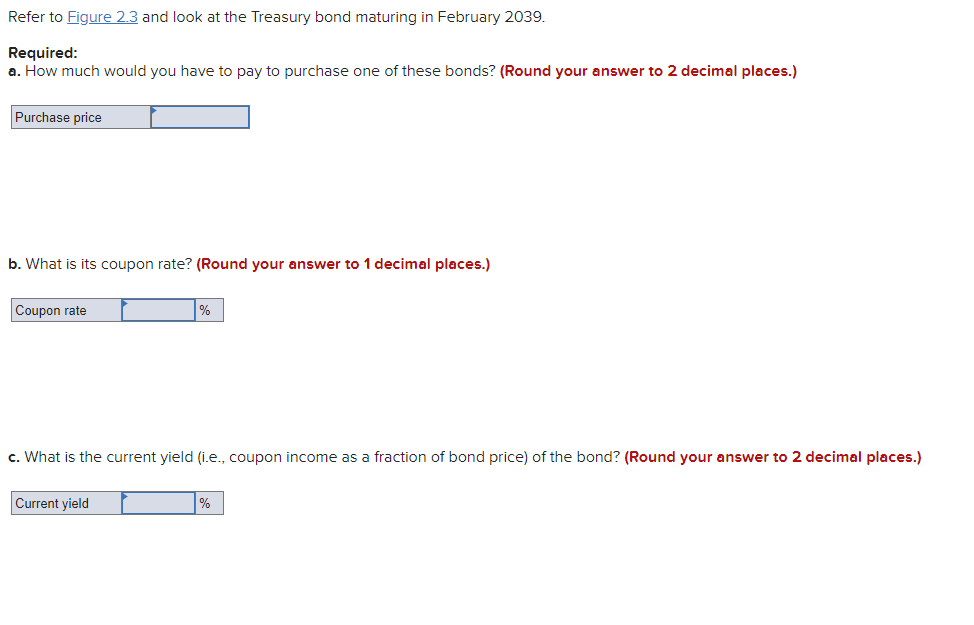

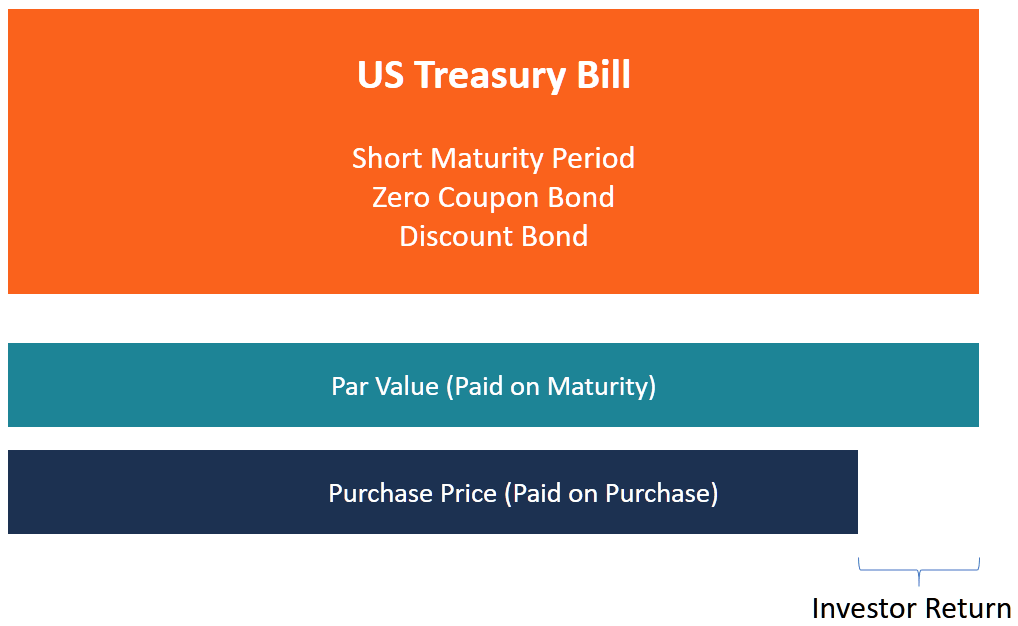

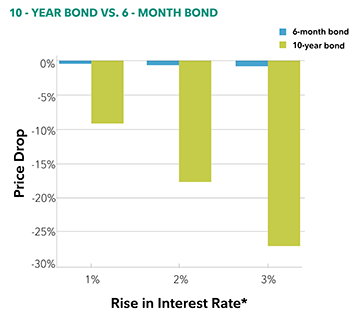

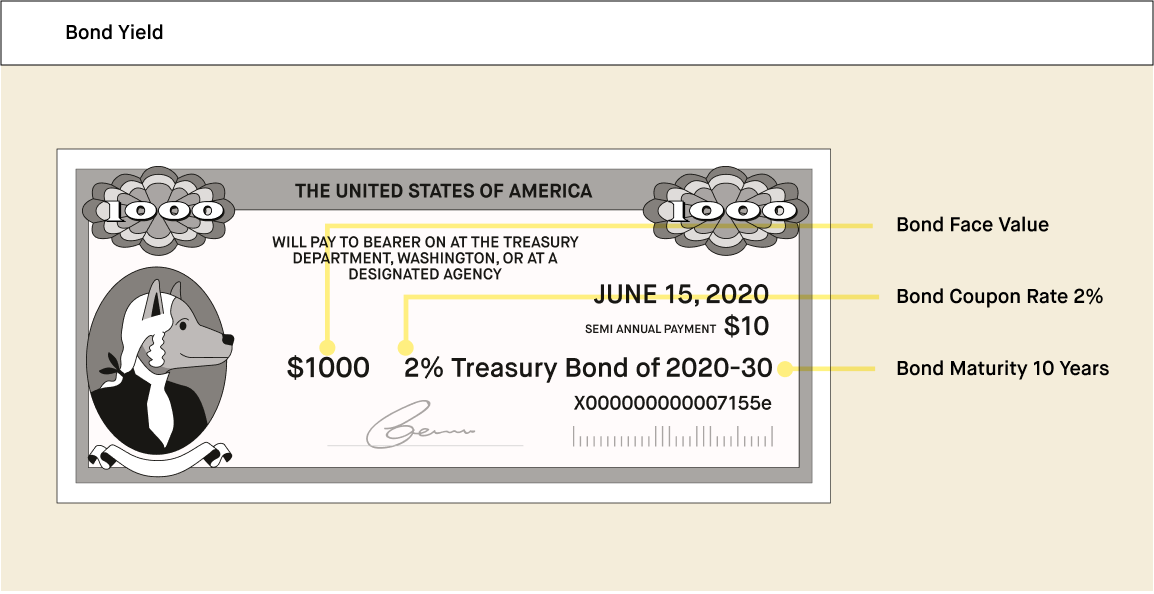

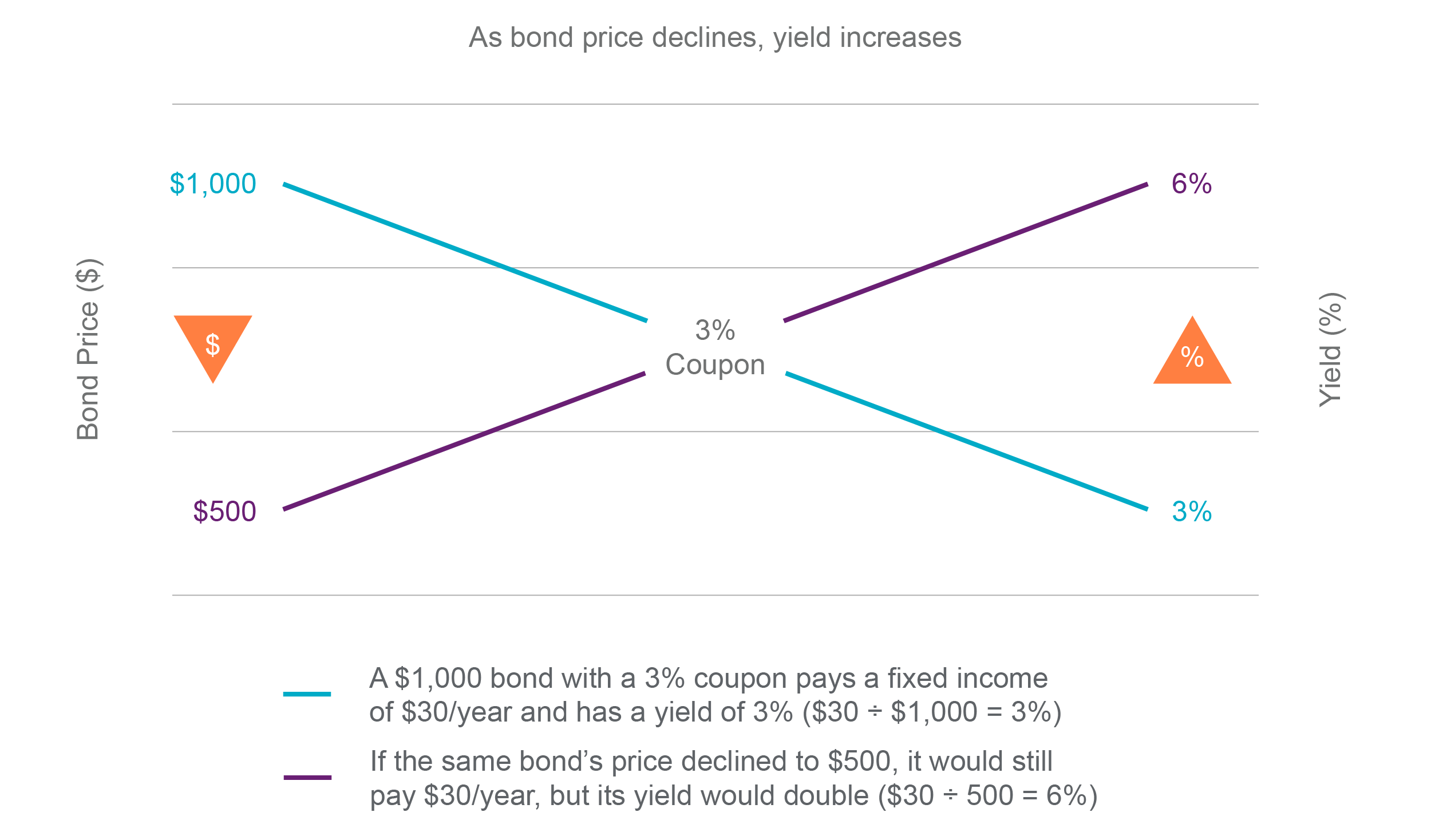

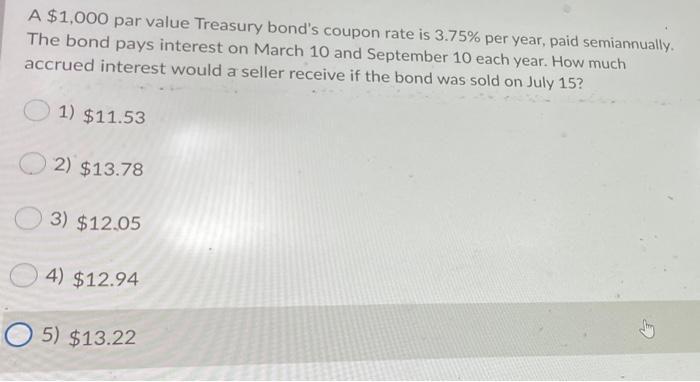

› us-treasury-bondsUS Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

Treasury bonds coupon rate

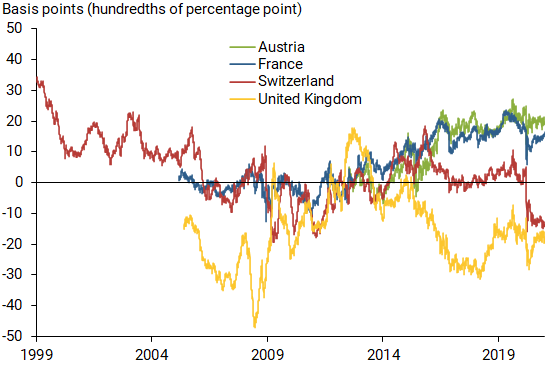

home.treasury.govFront page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Savings Bonds - Treasury Securities. ... Treasury Interest Rate Statistics . home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data › securities › treasury-bondsTreasury Bonds | CBK Most bonds auctioned by the Central Bank are fixed coupon Treasury bonds, which means that the interest rate associated with the bond will not change over the bond’s life, so semiannual interest payments from these bonds will stay the same. Infrastructure bonds are used by the government for specified infrastructure projects.

Treasury bonds coupon rate. slickdeals.net › f › 15758386US Treasury Series I Savings Bonds Inflation Rate Earnings ... Apr 28, 2022 · US government [treasurydirect.gov] is expected to pay 9.62% on its I-bonds in combined Fixed + Inflation Rate Earnings valid on newly issued Series I Savings Bonds purchased 05/01/22-10/30/22. In laymen's terms: These are safe U.S. treasury securities which adjust their interest rate every 6 months based on the current inflation rate. › securities › treasury-bondsTreasury Bonds | CBK Most bonds auctioned by the Central Bank are fixed coupon Treasury bonds, which means that the interest rate associated with the bond will not change over the bond’s life, so semiannual interest payments from these bonds will stay the same. Infrastructure bonds are used by the government for specified infrastructure projects. home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data home.treasury.govFront page | U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. ... Savings Bonds - Treasury Securities. ... Treasury Interest Rate Statistics .

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

Post a Comment for "41 treasury bonds coupon rate"