42 what is coupon payment of a bond

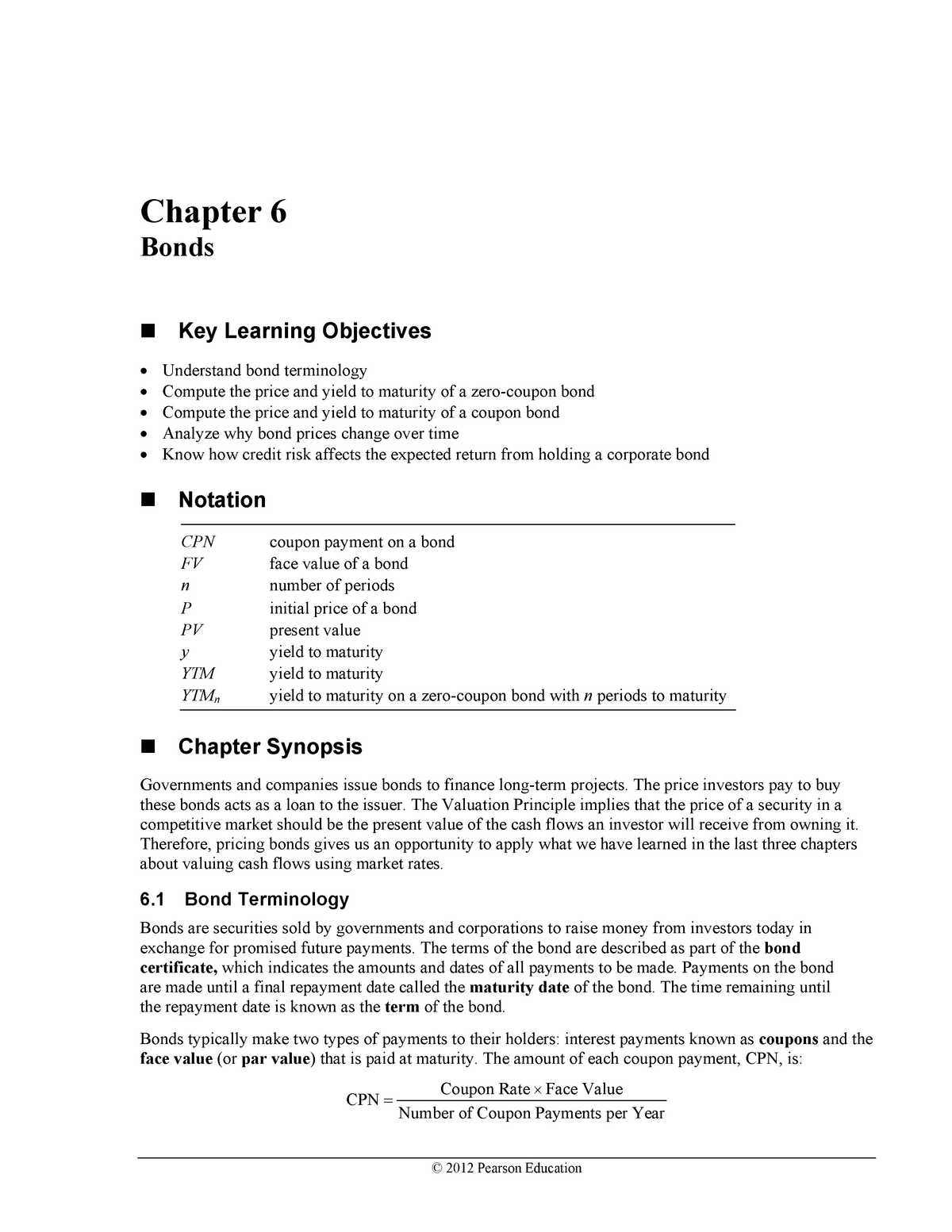

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are... Guide, Examples, How Coupon Bonds Work Updated October 13, 2022 What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

coupon payment on bond : r/interactivebrokers Coupon Payment: XXX@BONDDESK. XXX 0.95 04/01/24 announced a coupon payment, effective 20220929. The declared rate on the coupon payment will be USD 0.00475. I just received this message.

What is coupon payment of a bond

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. What Is Coupon Rate and How Do You Calculate It? Investors use the phrase "coupon rate" for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment. The term "coupon rate" specifies the rate of payment relative to a bond's par value. Secondly, a bond coupon is often expressed in a dollar amount. For example, a bank ... What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

What is coupon payment of a bond. Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are ... What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates. Coupon Payment - Investor.gov The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or ... Coupon Rate of a Bond - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. What Are Coupon Payments? - ClydeBank Media What are Coupon Payments? Coupon payment is the periodic payment of interest by a bond issuer to a bondholder. Coupon payment is not to be confused with stock dividend payment—the two are distinct in a few ways. When an investor or trader purchases shares of stock in a company, they are purchasing the rights to a portion of that company's profits. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Note Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a ... Coupon Rate Definition - Investopedia The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by ... Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

What Is Coupon Rate and How Do You Calculate It? Investors use the phrase "coupon rate" for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment. The term "coupon rate" specifies the rate of payment relative to a bond's par value. Secondly, a bond coupon is often expressed in a dollar amount. For example, a bank ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "42 what is coupon payment of a bond"