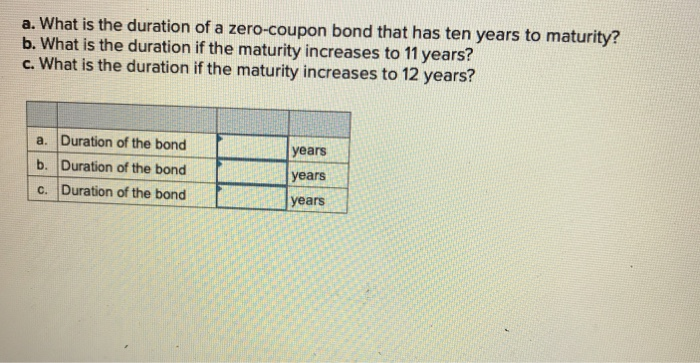

40 duration for zero coupon bond

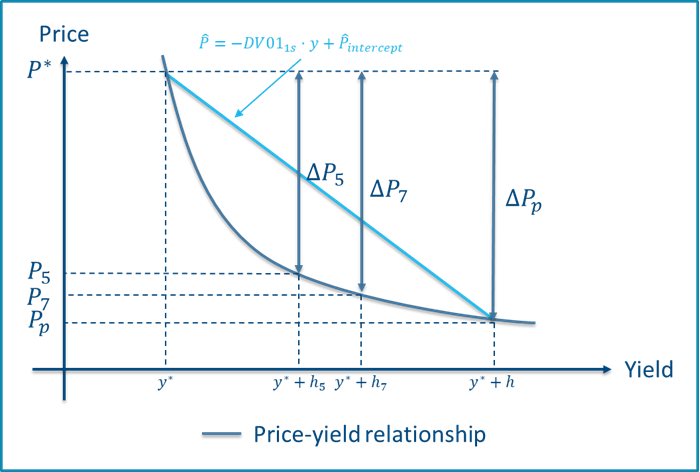

dqydj.com › bond-duration-calculatorBond Duration Calculator – Macaulay and Modified Duration Bond duration is a linear estimate of a bond's price sensitivity to changes in market yield. It's the first derivative of price with respect to market yield. However - the relationship between yield and price isn't linear, it's a curve. Bond convexity is the second derivative, and a measure of the "curvedness" of the relationship. What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... With zero-coupon bonds, the bondholders need to pay taxes associated with interest income, even though the particular gain has been realized or not. For example, with a bond that matures in 5 years, the lump sum return will only be generated at the end of the period. However, the bondholder must pay taxes, regardless of the time to maturity.

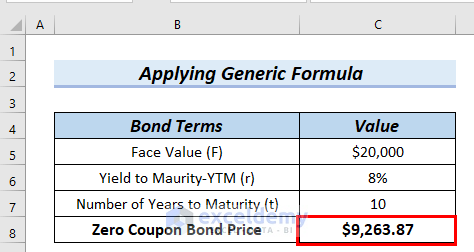

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

Duration for zero coupon bond

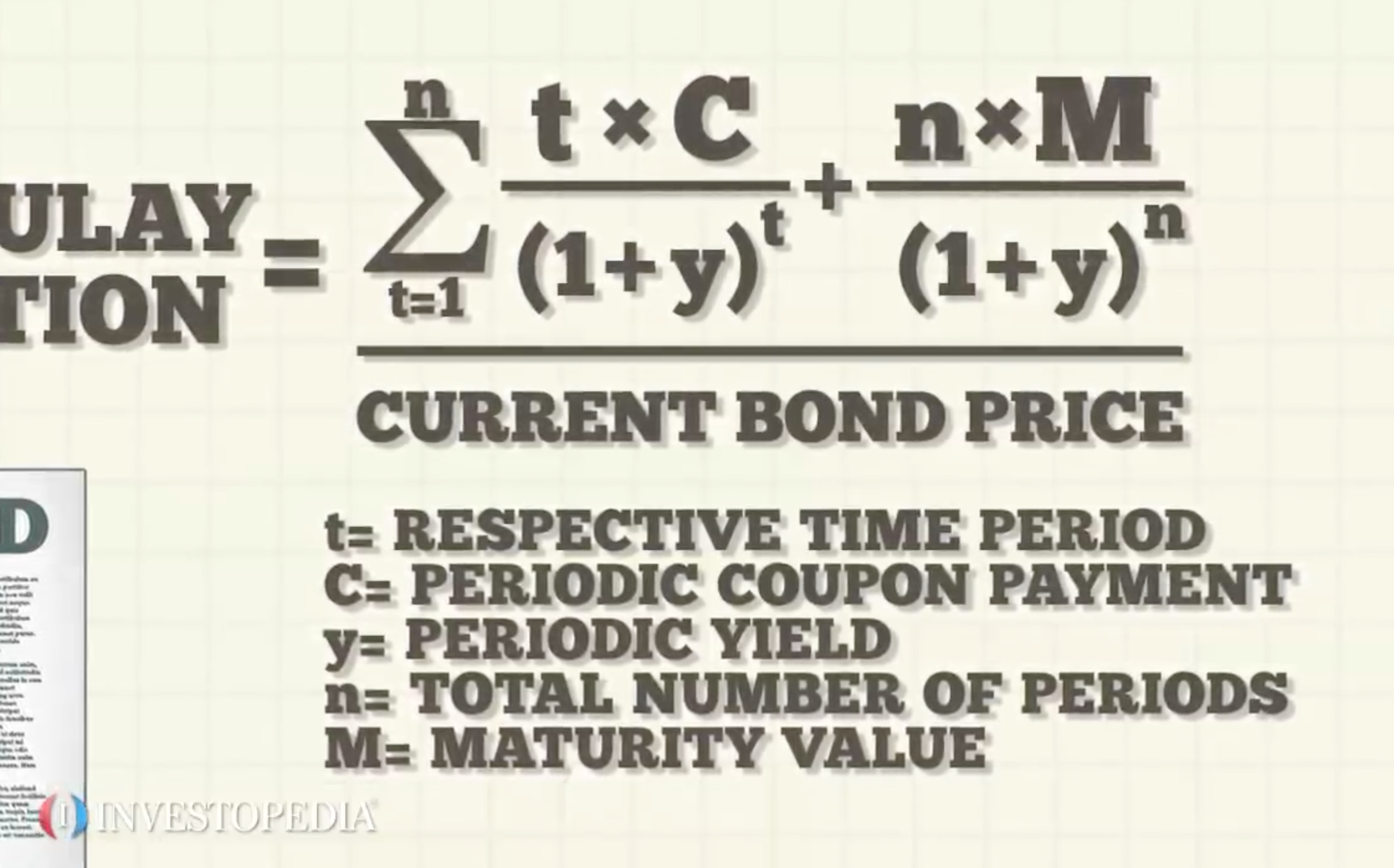

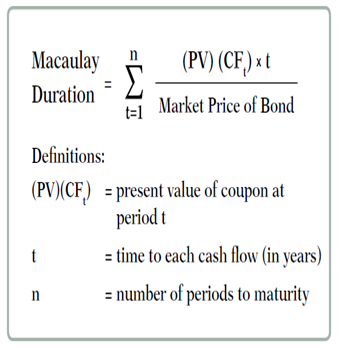

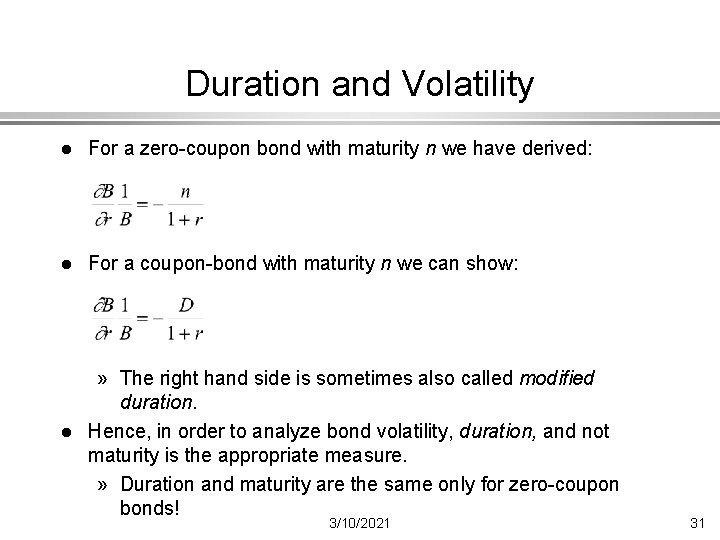

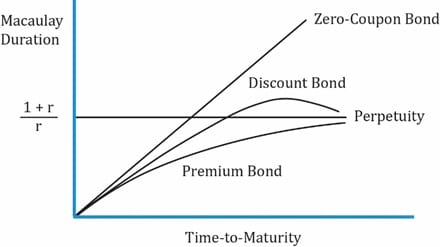

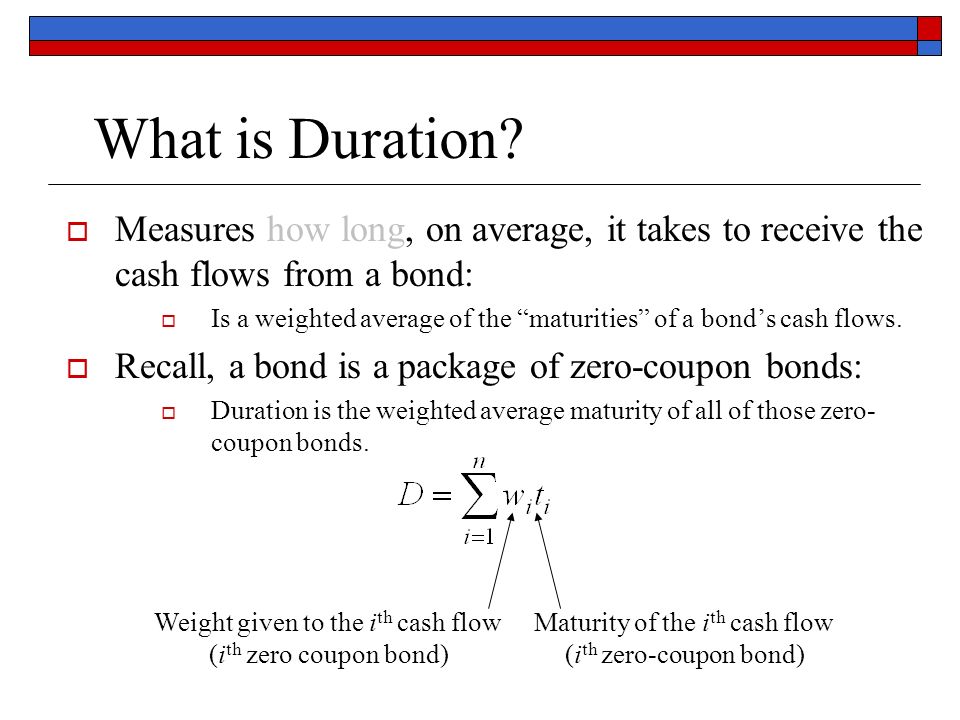

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield. Zero Coupon Bond Calculator - Nerd Counter The formula to calculate the duration that was given by Macaulay was then remembered as Macaulay's duration formula, which is written below: Macaulay Duration Formula = 1PV∑Tt=1 (t×PVt) If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT). › convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ...

Duration for zero coupon bond. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53, The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding, › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. ... Ext Duration Treasury ETF." PIMCO. "PIMCO ... How to Calculate Bond Duration - wikiHow 3. Clarify coupon payment details. To calculate bond duration, you will need to know the number of coupon payments made by the bond. This will depend on the maturity of the bond, which represents the "life" of the bond, between the purchase and maturity (when the face value is paid to the bondholder). Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are commonly issued by governments. In this article, we will have a closer look at the pros and cons of zero-coupon bonds from an investor's point of view: Pros of Zero-Coupon Bonds. There are many zero-coupon bonds that are already in existence. Also, each year, many new zero-coupon bonds are issued. Despite there being so ...

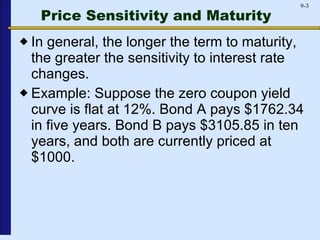

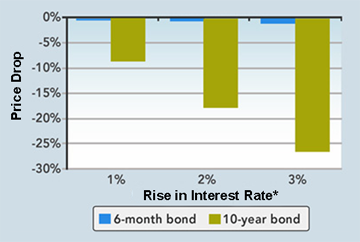

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) In this example the bondholder has to wait 10 years before they receive the face value of the bond. › investors › insightsThe One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... PDF Understanding Duration - BlackRock Duration can help predict the likely change in the price of a bond given achange in interest rates. As a general rule, for every 1% increase or decreasein interest rates, a bond's price will change approximately 1% in the oppositedirection for every year of duration. For example, if a bond has a duration of 5 years, and interest rates increase b...

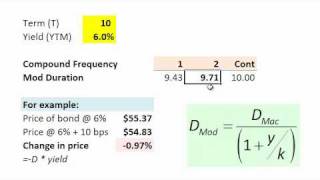

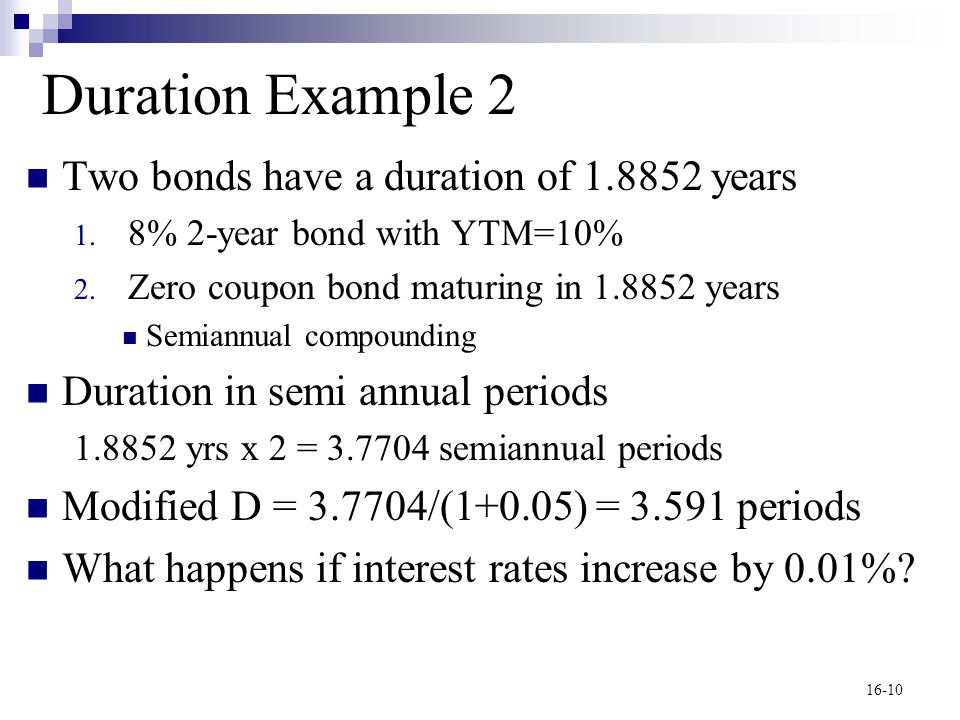

fixed income - Duration of callable zero coupon bond - Quantitative ... fixed income - Duration of callable zero coupon bond - Quantitative Finance Stack Exchange. 1. Can anybody please help me out with the below question with a brief explanation:-. A 10-year zero coupon bond is callable annually at par (its face value) starting at the beginning of year 6. Assume a flat yield curve of 10%. Macaulay Duration - Overview, How To Calculate, Factors Therefore, the Modified duration of the bond is 1.868 (1.915 / 1.025). It means for each percentage increase (decrease) in the interest rate, the price of the bond will fall (raise) by 1.868%. dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Zero Coupon Bond: Formula & Examples - Study.com Zero-Coupon Bond Definition: The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity ...

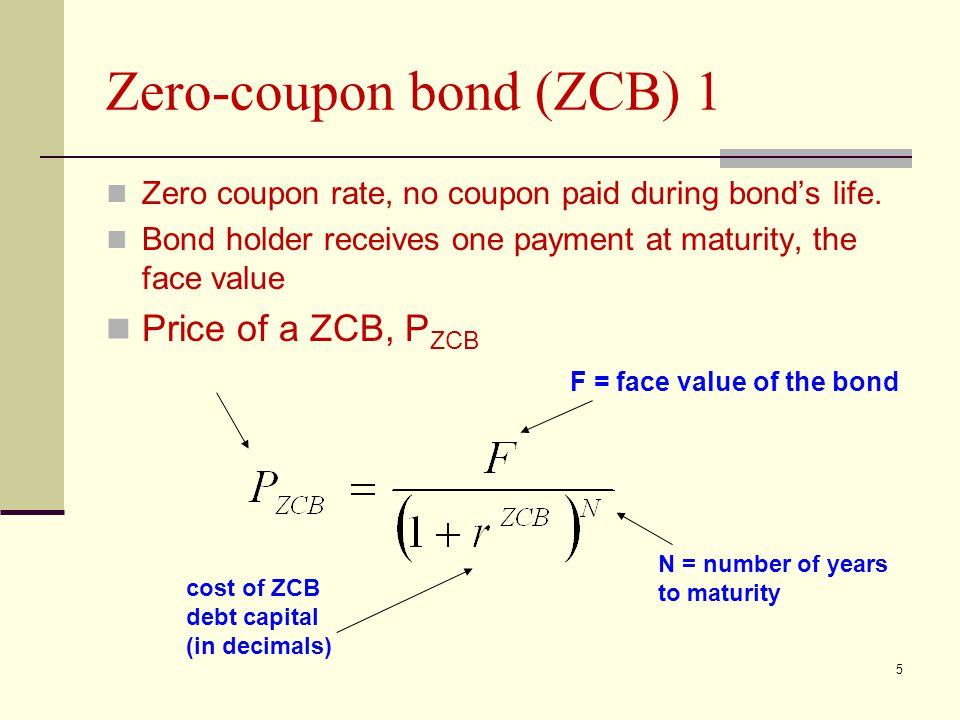

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula, Price of Bond (PV) = FV / (1 + r) ^ t, Where: PV = Present Value, FV = Future Value, r = Yield-to-Maturity (YTM) t = Number of Compounding Periods,

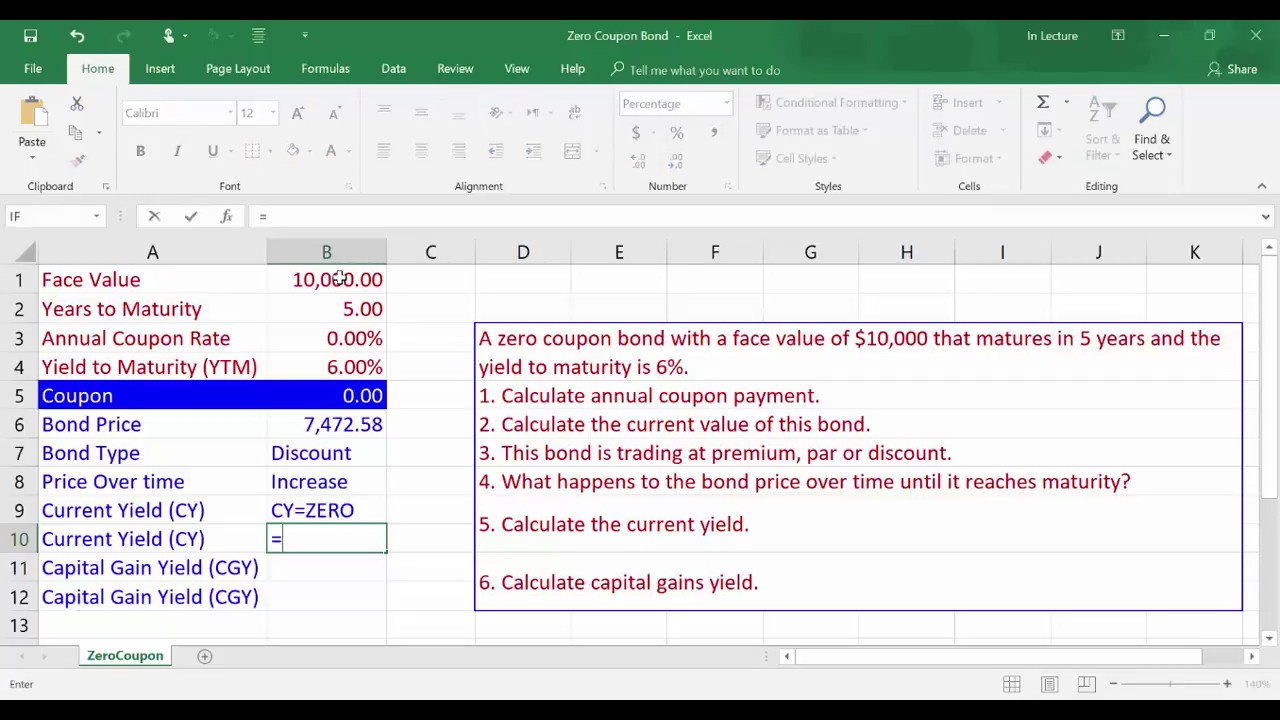

The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel, Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

› terms › dDuration Definition and Its Use in Fixed Income Investing Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

What is the duration of a zero coupon bond? - Quora the modified duration of a zero-coupon bond is the time til maturity. for example, the modified duration of a 10-year, zero-coupon bond is ten years. if you purchase the above bond when it is halfway to maturity, the modified duration is half that, or equal to five years. Quora User.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula, Sale Price = FV / (1 + IR) N,...

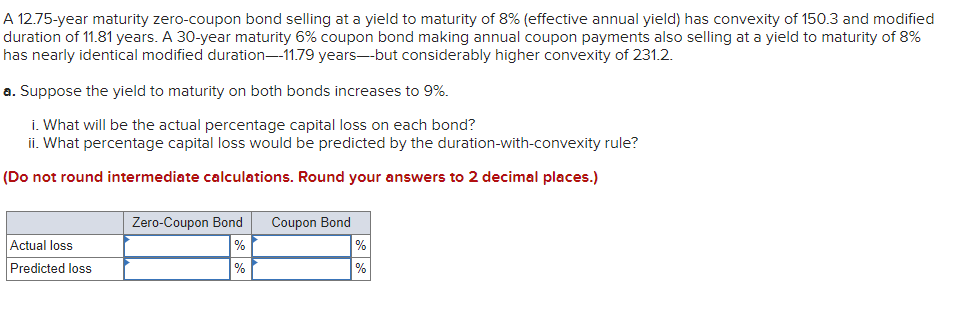

Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%.

duration of zero coupon bonds | Forum | Bionic Turtle With respect to a zero coupon bond, Macaulay duration = maturity, and therefore must be a monotonically increasing function of maturity. On the other hand, DV01 of a zero (or deeply discounted) is not strictly increasing as DV01 = P*D/10,000 and the numerator has offsetting effects. If you'd kindly reference, I can fix? Thanks! Apr 7, 2012, #3, S,

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, ... A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms ...

Default Risk and the Duration of Zero Coupon Bonds This paper applies a contingent claims approach to examine the duration of a zero coupon bond subject to default risk. One replicating portfolio for a default-prone zero coupon bond contains a long position in the default-free asset plus a short position in a put option on the underlying assets. The duration of the bond is shown to be a ...

What is the period of a zero coupon bond? | Personal Accounting The bond issuer pays interest to the bondholders for the duration of the bond's time period. Bonds are loan agreements involving creditors and borrowers. When Convertible Bonds Become Stock. ... Zero coupon bonds have a period equal to the bond's time to maturity, which makes them sensitive to any modifications within the rates of interest. ...

Duration Of A Zero Coupon Bond - bizimkonak.com Zero Coupon Bond Modified Duration Formula - Bionic … CODES (7 days ago) We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) … Visit URL. Category: coupon codes Show All Coupons

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

› convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ...

Zero Coupon Bond Calculator - Nerd Counter The formula to calculate the duration that was given by Macaulay was then remembered as Macaulay's duration formula, which is written below: Macaulay Duration Formula = 1PV∑Tt=1 (t×PVt) If there is no coupon bond, we can also calculate the duration by using the formula mentioned under: Macaulay Duration = 1PV (T×PVT).

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "40 duration for zero coupon bond"