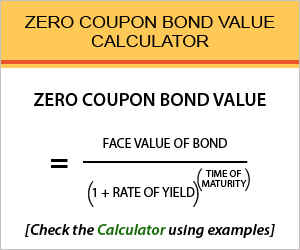

40 present value of zero coupon bond calculator

India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Get U.S. 10 Year Treasury (US10Y:Tradeweb) real-time stock quotes, news, price and financial information from CNBC.

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.414% yield. 10 Years vs 2 Years bond spread is 101.2 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

Present value of zero coupon bond calculator

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... How to calculate the term premium. FRED Blog Constructing "ex ante" real interest rates on FRED. ALFRED Vintage Series Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis. Other Formats. Annual, Not Seasonally Adjusted ... Reserve Bank of India - NSDP Display 2.94. 2.98. *As per Press Release No. 2022-2023/41 dated April 08, 2022. @ Financial Benchmarks India Private Limited (FBIL) has taken over from RBI, the computation and dissemination of reference rate for spot USD/INR and exchange rate of other major currencies with effect from July 10, 2018. # Ratios for all fortnights since December 3, 2021 ... Pension Calculator Investments Calculator Calculate the value of your investment in the future or how much you need to invest. Investments Comparison Calculator Compare the value of up to 3 investments in the future. View all Investments Calculators; investment deals . Managed Fund MFM Techinvest Special Situations; Managed Fund R&M UK Equity Smaller Companies B Acc

Present value of zero coupon bond calculator. South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 10.540% yield. 10 Years vs 2 Years bond spread is 364 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.50% (last modification in July 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. What to Do When Your Savings Bond Reaches Maturity As of November 2021, the I bond rate is 7.12%. Series EE savings bonds also mature after 30 years. Like I bonds, they will earn interest until they are redeemed. Series EE bonds differ from I ... What Is the Discount Rate? - The Motley Fool The Fed was able to step in with a series of measures to help prop up the economy in the short term. One move was to lower the federal funds rate to a target between 0% and 0.25%. It also lowered... ICE BofA US High Yield Index Option-Adjusted Spread - St. Louis Fed Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ...

General Obligation Bonds The bottom line on GO bonds. Investors tend to seek out municipal bonds for their safety, reliability, and tax advantages. General obligation bonds are a great option for fixed income investors ... How to Calculate the Present Value using Python - Exploring Finance Step 2: Calculate the Present Value. Next, you can use the template below in order to calculate the Present Value in Python: FV = Future Value r = Interest Rate n = Number of Periods PV = FV/ (1+r/100)**n print (PV) This is the complete Python code that you may use for our example: FV = 1000 r = 4 n = 7 PV = FV/ (1+r/100)**n print (PV) Daily Treasury Yield Curve Rates - YCharts Japan Government Bonds Interest Rates: Jul 24 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Jul 24 2022, 19:50 EDT: Euro Short-Term Rate: Jul 25 2022, 02:00 EDT: Spain Interest Rates: Jul 25 2022, 04:00 EDT: European Long Term Interest Rates: Jul 25 2022, 04:00 EDT: Secured Overnight Financing Rate Data: Jul 25 2022, 08:00 EDT: Bank of ... Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022. AAA RATED MUNI BONDS AA RATED MUNI BONDS

Government Bonds - Meaning, Types, Advantages & Disadvantages The nominal value of the bond is calculated based on the previous week's simple average closing price of 99.99% of purity gold. India Bullion and Jewellers Association Ltd (IBJA) publishes the price list. The denomination of these bonds is in terms of one gram of gold. Botswana Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Botswana Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. Current Rates | Edward Jones Zero Coupon Bonds These securities are derived from Government of Canada, Provincial Government, and Corporate bonds. The coupons are removed and sold as different securities. The zero coupon security carries the same backing as the original bond. Market and interest risks are greater with zero coupon securities than with the original bond. How to Invest in Bonds - The Motley Fool There are two ways to make money by investing in bonds. The first is to hold those bonds until their maturity date and collect interest payments on them. Bond interest is usually paid twice a year ...

Italy's Debt Clock: Realtime Demo Showing The Size Of ... - Commodity.com Zero-Coupon Bonds (CTZs): bonds that require investment capital below the nominal redemption value, with a maximum maturity of 24-months. Treasury Certificates (CCTs-eu): floating rate securities with maturity from 3 to 7 years. Treasury Bonds (BTPs): Treasury bonds are medium/long-term securities, with a fixed coupon paid every 6 months.

Accounts That Earn Compounding Interest - The Motley Fool This variable is also known as future value. Let's say you invested $10,000 in a savings account offering 1% interest compounding monthly. After five years, you would calculate the savings amount...

Loan Balance Calculator - TheMoneyCalculator.com To use it, all you need to do is: Enter the original Loan amount (the full amount when the loan was taken out) Enter the monthly payment you make Enter the annual interest rate Enter the current payment number you are at - if you are at month 6, enter 6 etc. Click Calculate!

Finally, A Safe Way To Play The Market — Upside Investing Consider spending $100,000 today on a zero-coupon, inflation-indexed Treasury bond that pays nothing for 30 years and $132,797 in today's dollars in year 30. (Note, such zero-coupon bonds are...

What Are I Bonds? How Do They Work? - Forbes Advisor I bonds are safe investments issued by the U.S. Treasury to protect your money from losing value due to inflation. Interest rates on I bonds are adjusted regularly to keep pace with rising prices ...

JOHNSON & JOHNSONLS-NOTES 2007(07/24) Bond - Insider The Johnson & Johnson-Bond has a maturity date of 11/6/2024 and offers a coupon of 5.5000%. The payment of the coupon will take place 1.0 times per Year on the 06.11..

Current Rates | Edward Jones Edward Jones Money Market Fund: Displays the 7-day current rate for Investment Shares and Retirement Shares for the Edward Jones Money Market Fund. Taxable Money Market Fund. 7-Day Current Yield (%) Investment Shares. 0.82%.

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.103% yield. 10 Years vs 2 Years bond spread is 28.9 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Tax Free Bond - REC Limited Annual Update Report for Green Bonds as on March 31, 2021. Tax Free Bond. Infrastructure Bonds. Taxable Bond. Forms for Bonds. Market Linked Debentures. Valuation of Market Linked Debentures. Unclaimed Shares/Debentures/ Dividend/ IEPF/ Interest. Unpaid Dividend and Unclaimed Matured Debentures and Interest thereon.

Live India Debt Clock Reflects Surge in Debt-to-GDP Ratio Due to Covid ... Zero-Coupon Bonds - Pay no interest but are sold at a discount and redeemed at full face value. Capital-Indexed Bonds - The face value of the bond increases in line with inflation. Inflation-Indexed Bonds - Both the loan amount and the interest are index-linked (since 2013 these bonds have been issued exclusively to the general public).

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.752% yield. 10 Years vs 2 Years bond spread is -21.8 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.75% (last modification in June 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

Pension Calculator Investments Calculator Calculate the value of your investment in the future or how much you need to invest. Investments Comparison Calculator Compare the value of up to 3 investments in the future. View all Investments Calculators; investment deals . Managed Fund MFM Techinvest Special Situations; Managed Fund R&M UK Equity Smaller Companies B Acc

Reserve Bank of India - NSDP Display 2.94. 2.98. *As per Press Release No. 2022-2023/41 dated April 08, 2022. @ Financial Benchmarks India Private Limited (FBIL) has taken over from RBI, the computation and dissemination of reference rate for spot USD/INR and exchange rate of other major currencies with effect from July 10, 2018. # Ratios for all fortnights since December 3, 2021 ...

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... How to calculate the term premium. FRED Blog Constructing "ex ante" real interest rates on FRED. ALFRED Vintage Series Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis. Other Formats. Annual, Not Seasonally Adjusted ...

Post a Comment for "40 present value of zero coupon bond calculator"